A Chinese-flagged oil tanker reportedly changed its name in order to avoid US sanctions on Iranian oil, Reuters reported.

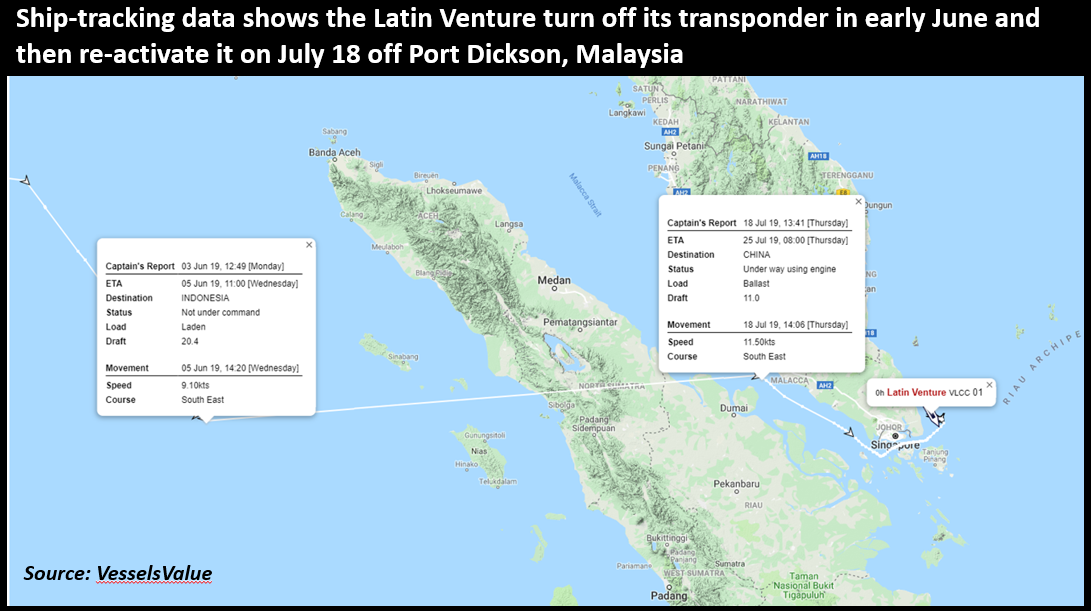

The very large crude carrier (VLCC) Pacific Bravo went dark in the Pacific Ocean by shutting off its transponder on June 5th, according to ship tracking data.

On July 18th, the transponder of the VLCC Latin Venture was activated offshore Port Dickson, Malaysia, in the Strait of Malacca, about 1,500 km from where the Pacific Bravo “disappeared.”

Both the Latin Venture and the Pacific Bravo transmitted the same unique identification number, IMO9206035, issued by the International Maritime Organization (IMO), according to data from information provider Refinitiv and VesselsValue, a company that tracks ships and vessel transactions.

IMO Numbers remain with a ship “for life,” that suggests that the Latin Venture and the Pacific Bravo were the same vessels and also “suggested the owner was trying to evade Iranian oil sanctions.” How that connection was made remains unclear, since there’s really no evidence.

According to Reuters an unnamed US official warned ports in Asia to not allow the Latin Venture to port, because it was allegedly carrying Iranian crude oil in violation of US sanctions on the Islamic Republic.

A VLCC usually carries 2 million barrels, worth approximately $120 million.

“Without speculating on any particular shipowners’ actions, generally speaking for a ship to change its name abruptly after receiving accusations from the U.S., it can only be that the owner is hopeful that the market will be deceived by something as rudimentary as a name change,” said Matt Stanley, an oil broker at StarFuels in Dubai.

The Latin Venture is owned by Kunlun Holdings, which is based in Shanghai, according to Equasis.org, it also has an office in Singapore.

Reuters attempted to contact the company but there was no response.

The Pacific Bravo was also full of cargo, and when it vanished for 42 days and reappeared as the Latin Venture it was empty, according to Refinitiv and VesselsValue data.

According to a statement from the Marine Department Malaysia, the Latin Venture entered Port Dickson on June 29th for a crew change and departed on July 18th and unloaded no cargo while there.

After departing the Malaysian port, the tanker sailed past Singapore to the southeastern coast of Malaysia and on July 25th it transmitted that its cargo tanks were nearly full. As of August 14th, the ship remains there, ship-tracking data shows. There is no way to determine the origin of the cargo’s contents.

The Iranian side has provided no comment.

Reuters asked the Chinese Foreign Ministry for a comment, and it alleged was “not aware of this particular situation.” But China does oppose the US’ unilateral sanctions on Iran, and “long-armed jurisdiction”, according to a Foreign Ministry spokesperson.

“The global community, including China, is legally engaged in normal co-operation with Iran within the framework of international law, which deserves to be respected and protected,” the spokesperson said.

On August 1st, Reuters also requested a comment from the US State Department and got a response:

“We do not preview our sanctions activities, but we will continue to look for ways to impose costs on Iran in an effort to convince the Iranian regime that its campaign of destabilizing activities will entail significant costs.”

U.S. Secretary of State Mike Pompeo said on July 22nd that the U.S. imposed sanctions on Chinese entity Zhuhai Zhenrong and its CEO Youmin Lin because “they violated U.S. law by accepting crude oil.”

“The U.S. is serious about enforcing our sanctions on the outlaw regime in Iran. So today, we’re taking action against a Chinese company that acquired Iranian oil contrary to U.S. sanctions. No entity should support the regime’s destabilizing conduct by providing it with money,” Secretary Pompeo said.

In June 2019, Iranian oil purchases by China were reduced, as the US sanction waivers were not renewed following May 2nd.

According to Chinese customs data, cited by Reuters, Iran sent a bit over 208,000 bpd of crude to China, which was down from over 250,000 bpd in May while the waivers were still in effect. Reuters Refinitiv data showed that the bulk of the Iranian oil shipments to China in June were unloaded at the port of Tianjin, at 163,000 bpd.

For India, in April purchases of Iranian oil were up 5% year on year, despite the sanctions in March, since the waiver was still in effect.

After the waiver was not renewed, on May 24th, Indian Ambassador to the US Harsh Vardhan Shringla said India stopped importing oil from Iran after the United States refused to extend exemption from sanctions.

As of late April, India had dropped its dependency on Iranian oil from about 2.5 billion tonnes a month to 1 million tonnes a month, he said.

“We do understand that this has been a priority for the US administration, although it comes at a cost to us because we really need to find alternative sources of energy,” Shringla said.

Iran earlier used to supply 10 per cent of India’s oil needs.

As of July 3rd, India still imported Iranian oil. Minister of State for External Affairs V. Muraleedharan said that bilateral trade with Iran, including oil imports wouldn’t stop.

To a direct question on whether the government would “withdraw or discontinue” trade with Iran, Minister of State for External Affairs V. Muraleedharan said, “No.”

“Prime Minister [Modi] pointed out that although Iran supplies 11% of our energy, India had reduced oil imports from Iran […] despite the effect it had on the Indian economy, [and] we had been able to sustain this position,” Foreign Secretary Vijay Gokhale said.

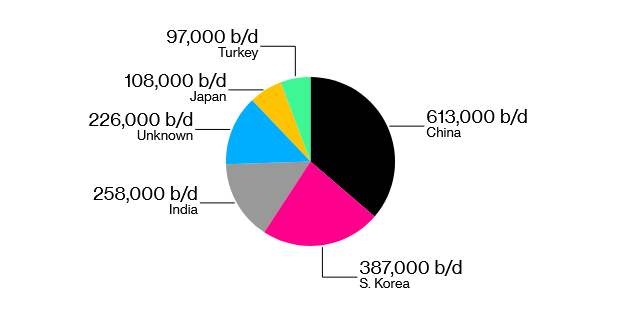

In March 2019, purchases of Iranian crude oil looked the following way:

MORE ON THE TOPIC: